Small Business Payroll

& Tax Services

Make Payroll Simple

Payroll shouldn’t be a second job

Confused by deadlines, forms, and changing tax rules? You’re not alone. We simplify payroll and employment tax compliance, helping you avoid mistakes and stay confident you’re doing it right.

Focus on Your Business

From paycheck calculations to tax filings, we handle the behind-the-scenes work so you can give your full attention to your clients, your team, and your goals.

Simplify, not Sacrifice

Our easy-to-use payroll platform is backed by responsive, human support—no bots, no runaround. Your dedicated rep is here to help when you need answers.

What We Do

At PayrollUSA, we take the stress out of payroll. From tax filings to direct deposit and HR support, we keep things running smoothly—so you never have to worry about deadlines, penalties, or confusing paperwork.

With decades of industry experience and pricing designed for small business budgets, we offer smart, reliable payroll solutions that won’t break the bank. We’re proud to serve businesses across the country with trusted expertise and personal support.

Your payroll taxes filed on-time, automatically.

- Automated Processes: Streamline your payroll with automated processing, reducing errors and saving time.

- Easy End-of-Year Filing: Simplify your end-of-year filing with our guaranteed compliance at all levels.

- Time Tracker: Keep track of employee work hours accurately and efficiently.

- Guaranteed Compliance: Rest assured that all your payroll and tax obligations are met.

Expert Payroll Solutions

We make payroll feel easy—because it should be.

From employee onboarding to tax filings, our all-in-one payroll service takes the stress off your plate. We handle every detail accurately and on time, so you can focus on growing your business—not chasing paperwork.

At PayrollUSA, we know no two businesses are the same. Whether you’re running a local family shop or scaling a fast-growing startup, our flexible payroll solutions and experienced team are here to deliver friendly, reliable support you can count on.

Support from the experts in payroll and taxes.

Help from humans, not hold music.

When you have a question, you deserve more than an automated reply. That’s why we pair every client with a real person who’s ready to help—no scripts, no bouncing between departments, just clear answers when you need them.

We’re here to make payroll feel simple and stress-free—because your time is better spent running your business.

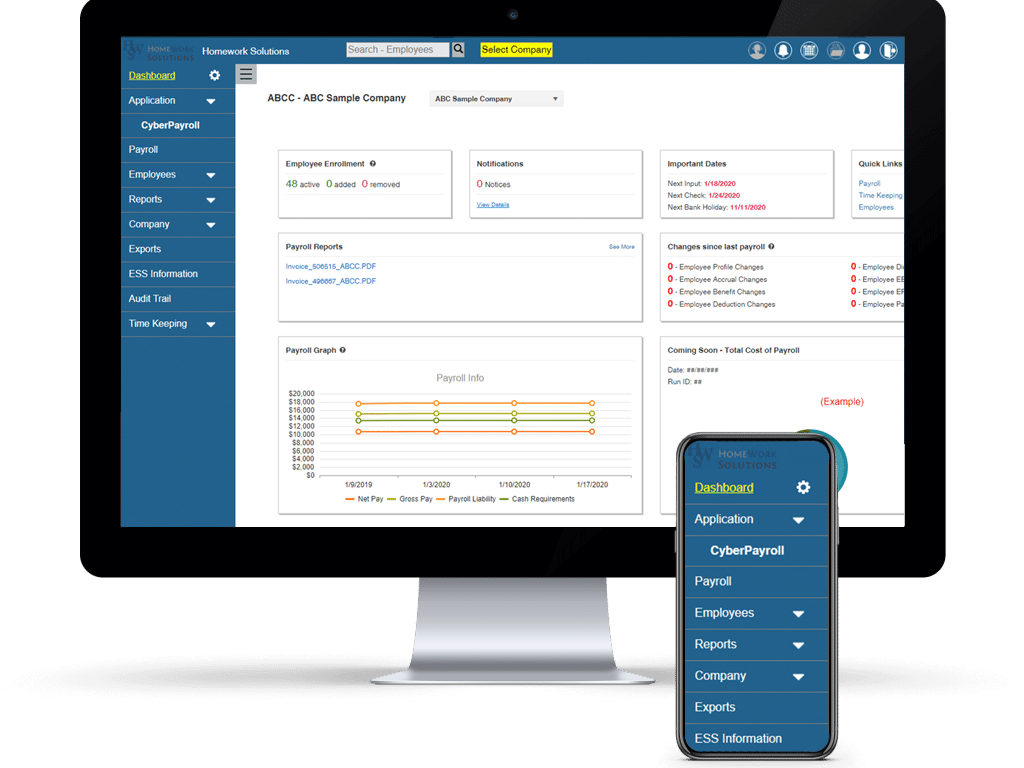

Access and Control to Keep Payroll Running Smoothly

Our user-friendly portal puts you in the driver’s seat. Access payroll info anytime, anywhere—24/7. With full visibility and simple tools, you stay organized and on track—so you never miss a payroll deadline again.

We’ll make sure everything is filed.

With over three decades of payroll experience, we know how to keep things on track. From 941s and unemployment taxes to year-end W-2s, we handle every filing accurately and on time—so you don’t have to worry about penalties, notices, or missed deadlines.

Automated Taxes

Taxes are filed for you, so you don’t have to lift a finger.

W2s and 1099s

We take the guesswork out of year-end. From gathering the right info to generating and filing forms, we make sure your W-2s and 1099s are accurate, on time, and fully compliant

Payroll

Whether you run payroll weekly, bi-weekly, or monthly, we’ve got you covered. Our system keeps things accurate, on time, and hassle-free—no matter how often you pay your team.

New hire reporting

We will collect and report necessary data to the IRS and state, so you don’t have to worry about it.

24/7 Portal

Need access to payroll details after hours? No problem. Our portal is available 24 hours a day, 7 days a week.

Dedicated Customer Rep

Real support from someone who knows your business. You’ll be paired with a knowledgeable representative who’s here to answer questions, offer guidance, and resolve issues quickly.

Frequently Asked Questions

Our services simplify payroll processing, ensuring compliance with both federal and local taxes. Our Premier Plan goes a step further and includes guidance on unemployment benefits and workers’ compensation, ensuring that you and your employees are fully covered. This plan also includes human resource expertise to provide guidance and payment processing for benefits administration like health insurance, onboarding, and more.

As an online payroll service, we prioritize the security of your personal information with thorough security policies and encryption methods to protect your data throughout the payroll process.

Unlike other payroll companies, we offer personalized service, extensive experience in payroll tax compliance, and the ability to handle complex payroll needs with ease. Our plans are designed to offer the best payroll software and HR solutions for small business owners and households alike, without any hidden additional fees.

Yes, Payroll USA allows you to process payroll for multiple employees. Our payroll provider services are flexible, offering unlimited payroll runs and customizable options to meet the needs of small businesses, independent contractors, and households alike.

In addition to payroll processing, Payroll USA provides HR services, benefits administration, and workers compensation guidance. Our Complete Payroll and Premier plans offer comprehensive HR solutions, such as onboarding, direct deposit, and contractor payments, to help manage your business efficiently.

No, Payroll USA includes access to our mobile app at no additional charge. Our mobile app allows you to process payroll, view pay periods, and manage payroll needs on the go, giving you flexibility and control over your business from anywhere.

Yes, we regularly update our payroll software with new features designed to improve payroll processing and HR services. Our latest updates include enhanced security policies, improved direct deposit functionality, and expanded options for benefits administration, ensuring you have access to the best tools to manage your payroll efficiently.